3.12.2 Establishing Payroll Deductions

Jan/29/2009

Note: Please

consult your Accountant before you set up your deductions for the first time to

make sure you have the latest information for with holdings in

Payroll.

Tradepoint's payroll structure supports an

unlimited amount of deductions. This allows you to have not only the standard

deductions for governmental deductions but additional ones for items like

savings or health plans offered with some companies.

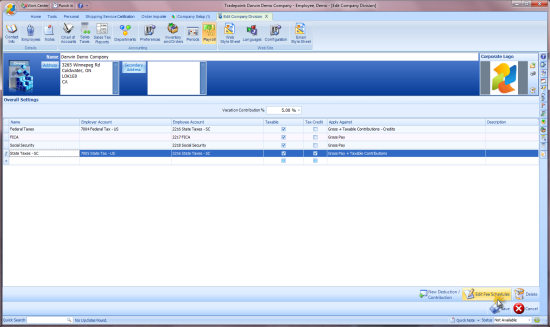

Basic Payroll

deductions are created within the main Payroll Deductions settings in the screen

below. The second step is to edit the Fee Schedules of each of the deductions to

create the details for the relevant income ranges and States/Provinces as well.

In this example there are four

payroll deductions listed. Each of those deductions can have multiple Fee

Schedules.

Each of the fields above can be typed into and for each of

the Accounts you will have a drop down menu to access the respective Account

from the COA (chart of accounts).

The next step will be establishing the

Fee Schedules for each of these deductions.