1.2 Company Setup

Aug/25/2007

One of the first things to set up

within Tradepoint is the Company Profile. This section will be what your

Employees are assigned to and will determine how your Inventory and

Accounting preferences reflect your business processes.

Getting to the Company Profile is

done through this path.

From the Tools Tab  click on the

Company icon

click on the

Company icon  . Click the New

icon in the lower left corner

. Click the New

icon in the lower left corner  to create a new

Company profile. A new screen will open under the Contact Information

section. Enter in your Company's contact information and then click the

Divisions icon

to create a new

Company profile. A new screen will open under the Contact Information

section. Enter in your Company's contact information and then click the

Divisions icon to add a new

division.

to add a new

division.

Since Tradepoint allows you to have

multiple companies, each with multiple Divisions if that is the structure of

your organization. This way you will be able to have more than one General

Ledger for each respective organization. If your company only has one

division then the New division will be the only Division for your Company.

The main icons within the Divisions

section that you will need to setup are shown below.

Setting up the Chart of Accounts,

any relevant sales taxes, departments(if necessary), Preferences(your Chart of

Accounts needs to be set up before you can complete this section), and any

Inventory and Orders preferences about how you handle your Products and related

processes.

Chart of

Accounts-Setting up your Chart of Accounts can be done manually or

though an Import(such as a Quickbooks IIF File). Please consult with your

Accountant prior to or in conjunction with setting up the Chart of Accounts for

your business. Going from one type of software to another is a good time to make

any changes in your existing structure. However, making a change to an existing

Chart of Accounts should not be done without the advice of an

Accountant.

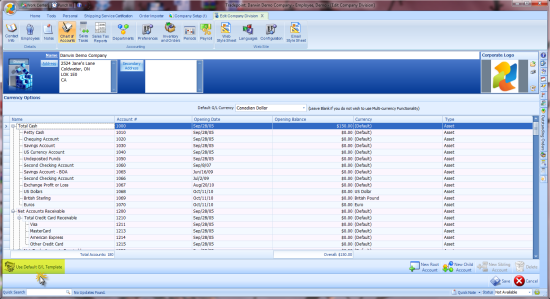

Tradepoint comes with a ledger

template.The icon on the lower left of the Chart of Accounts will load the

Ledger template into the Division settings.

The Accounts structure can be edited

with the icons on the lower right hand side of the screen. Each field can also

be edited by clicking on the field and making the adjustments using the existing

properties for that field. Simply highlight the account and edit any necessary

field from the chosen template you would like to adjust.

It is important to note that the

structure of your General Ledger should be as complete as possible here to be

able to set the rest of the Accounting Preferences within the Company

Division.

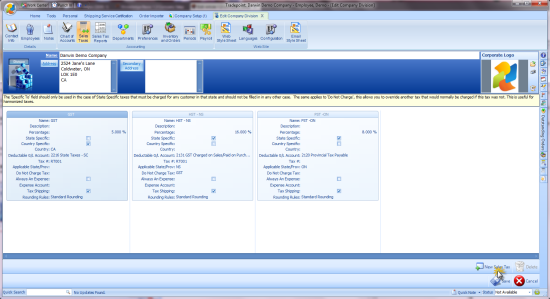

Sales

Taxes-Tradepoint allows you to set in the background any sales

taxes based on locality, State/province or Country in the background on the

basis of location where your Customers are when they purchase your Products

and Services and/or your Products and Services directly.

Clicking the New Sales Tax icon in

the lower right will open a new box to specify the details of the Sales Tax you

have created. Save your changes when you are finished and Sales Taxes will apply

based on the specifics stated in this section.

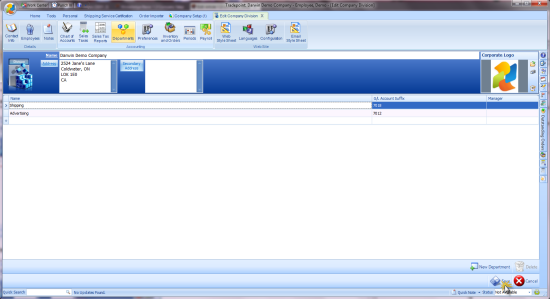

Departments-If your

business includes Departments as part of its structure you can define that

Department and the relevant G/L Account that is assigned to this account. Any

Activity pertinent to the Department will be associated with the Specified

Account set up in this section of your Company Settings.

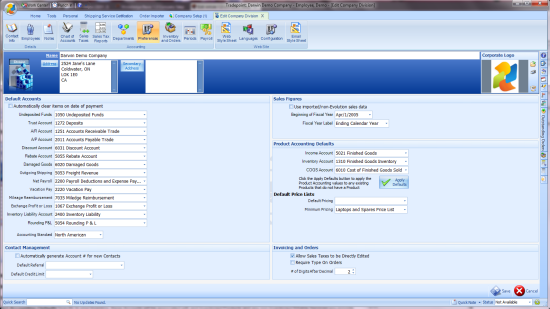

Preferences-Accounting

preferences and basic information about how your company is run can be specified

within this section.

Default

Accounts-Set up which Accounts within your G/L structure will

determine which Accounts activity will track to as you conduct

business.

Contact Management-Tradepoint

can generate new Account Numbers for you for each new contact

created.

Sales Figures-Basic information

defining the parameters of your company's operations of the course of its fiscal

year.

Product Accounting

Defaults-Specific to your Inventory, these Accounts will be

associated with and Inventoried Products and any non-Inventoried Billable

Services you provide within the Products section of Supply Side

Management.

Invoicing-These preferences

will determine if you need to have your Sales Tax to be editable and if you need

to be able to charge Sales tax on Shipping. When either of these Preferences are

specified this functionality will be enabled as you process and ship

Orders.

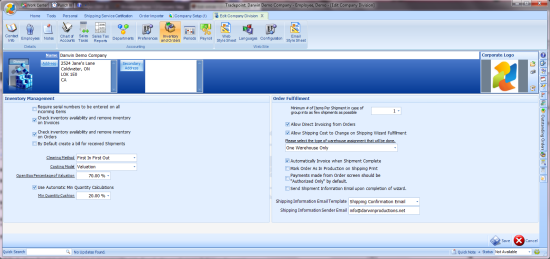

Inventory and

Orders-Tradepoint allows you to specify which Preferences you

would like to set for how you handle the day to day operations regarding your

Inventory and orders.

Payroll

Deductions- Establish which payroll deductions you withhold

for Payroll within your Company Settings on this screen.

Processes here include automatically

adjusting Inventory levels when Orders are shipped and when Invoices are

generated, the Inventory Liability Account, Direct Invoicing on Orders,

assigning one or more Warehouses and others. These Preferences can be adjusted

after the fact should you business processes change over time.

Save your changes when you are

finished and the Preferences will be set within Tradepoint to operate within the

background as you run your business.