3.12.3 Fee Schedules within Payroll Deductions

Jan/29/2009

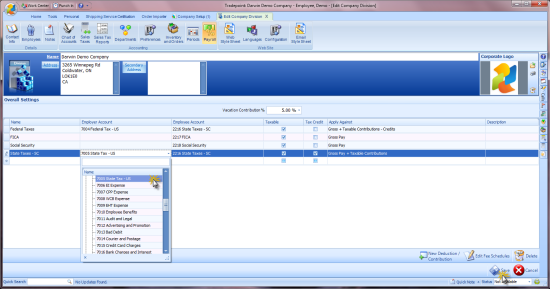

To create and/or access those Fee

Schedules highlight one of the deductions and click the "Edit Fee Schedules'

icon in the lower right of the screen.

Note: Each Payroll

deduction can have multiple Fee Schedules attached and if you have Employees

working in multiple states this may be the case.

The next

screen will have the fields for applicable parameters and for income ranges that

percentages can be applied to. Each of the main fields in the top of the page is

optional since multiple combinations of information may be the

case.

If the

deduction is applicable on a national level then keep the State field blank.

If an income 'floor' or 'ceiling' is not applicable in the case of your

Fee Schedule then leave those blank and enter in the income

ranges.

Each listed income range is a Fee

Schedule and multiple Fee Schedules can be created with the 'New Fee Schedule'

icon in the lower right.

The fields for Employer and Employee

deductions can be set up for percentages or fixed amounts for each Fee Schedule

with each income range.

When all of your deductions have been set up save

your changes.

The second part of Payroll

preferences will be explained as being specific to each Employee, when Employee

profiles with schedules are setup.

Related Articles

<Articles>