3.10.1 Invoicing and Orders Preferences

Jan/29/2009

Preferences for managing Inventory

and Order Fulfillment are addressed with these Preferences. Inventory management

preferences will apply to internal activity as well as web based activity from

one or more websites.

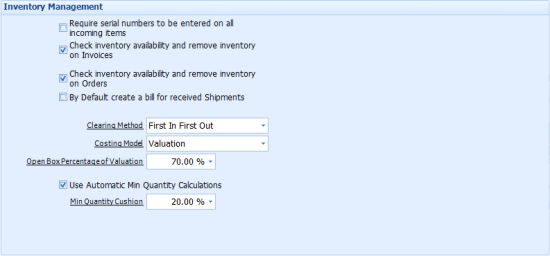

The Inventory Management section is

explained in detail in this article as highlighted with the image

below.

Inventory

Management: If your inventory requires serial numbers this first option will

require all Inventory being brought into Tradepoint to enter in the serial

numbers then. If your Inventory has some serialized items but not all of them

then a setting for your Product to be a serialized item will also prompt you to

enter in serial numbers on only those items that are serialized and not ALL

Products.

Note: These preferences will carry through to

using bar code systems as well so any serialized items will be able to be

scanned into Inventory as well as on Order Fulfillment.

The

two next preferences determine at what point in your sales process your

Inventory numbers are updated for checking Inventory availability and removing

Inventory as sales are processed.

For Inventory to be updated

at the point of Orders check off the first option and

for updating Inventory levels at the point of Invoices then check off the second

option to check availability an update Inventory when an Invoice is

generated.

Most companies will need to have the first option to have

Inventory updated and to check availability levels when an order is generated.

This will also allow Inventory availability to be viewable on all Orders

generated internally within Tradepoint.

Create a Bill for Incoming

Shipments: On any incoming shipments this option will automatically generate

a Bill for any items that are received into Inventory. The receiving wizard has

an option for this at the end of the Receiving wizard.

Inventory

Liability Account: This is a required account for anyone which has

physically inventoried items. First a few things about receiving

inventory.

There are two ways of receiving inventory:

1. Some

software applications (including QuickBooks and Simply Accounting) receive

inventory and put it in a "hold". It can't be sold until you have the invoice

from the supplier. That's because the reciprocal in their case is the bill to

the inventory asset account for that item (i.e. the expense = the asset in

inventory). This is the super simple way to do inventory but it also means that

you can't sell product until the bill is received.

2. The second

methodology, which Tradepoint uses, follows advanced accounting system (like

AccPac) methodologies. The asset value of the items is estimated by the product

valuations (or other costing models, averages and per Purchase Order, on the

main page of the product screen) plus any duties and fees that you estimate on

the purchase order. These valuations are used to store the inventory and

allow you to sell that inventory immediately. To do this, the reciprocal

account of the inventory asset account, instead of being the bill's expense

account is the Inventory Liability Account.

Note: With the

QuickBooks model it works the exact opposite of an A/R Invoice. This means that

two G/L entries are done for each line item: One G/L entry is the expense that

is the reciprocal of the A/P account and the other G/L entry is the reciprocal

of the Inventory Asset.

With Tradepoint, that is

NOT necessary on the Bill. Instead Tradepoint supports

the A/P reciprocal expense (i.e. the total of the line items + shipping + taxes

= the A/P General Ledger entry created when the Bill is

completed).

Clearing Method: First In First Out or Last in First

Out are your Options. The vast majority of companies will use the 'First in

First Out' option.

Costing Model: Tradepoint supports three

costing models Valuations, Averages, or Per Purchase Order. Most companies will

use Valuations. Industries that see a great deal of price fluctuations from

Suppliers will use either Averages or Per Purchase Orders.

Open Box

Percentage of Valuation: When your company processes a return, refund or

exchange, items have three basic states: Like New, Open Box, and

Damaged.

1. Like New goes back into inventory at 100% value.

2. Open Box goes in at whatever percentage you put in the "open box

percentage of valuation".

3. Damaged is written off at 100% of the

original value and put in the damaged goods COGS account.

Use

Automatic Min Quantity Calculations: This is an adjustable percentage used

for fuzzy logic to generate suggestions of products to be reordered.

Essentially, the percentage generates a gap required to keep enough Inventory on

hand over time.

For example, if you sell 50 items a day, and it takes

you 3 days to order, you'll want a cushion of 150 items. The Min Quantity will

be the minimum number you need to keep in stock for the duration it takes to get

the items into inventory so that you can sell them.