Reporting on Sales Tax activity varies depending on the country and

state/province where business is done. Tradepoint sales tax reporting supports

date ranges for monthly, quarterly and yearly.

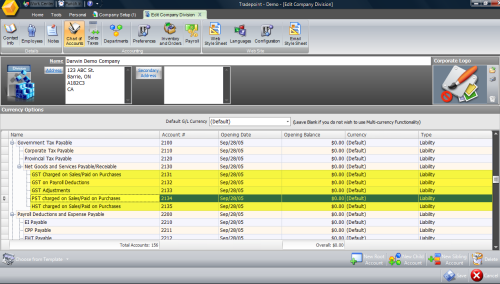

We recommend having General ledger Accounts setup for each of the

sales taxes whether national or provinicial (by state)a business has to collect

and report on. An example of this within a General ledger will appear like the

example shown below:

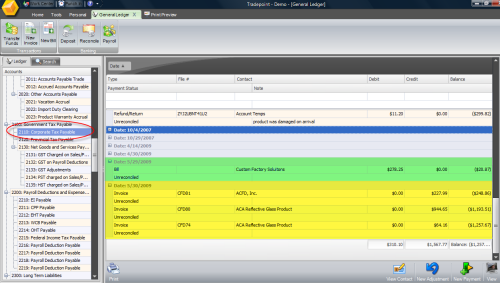

Once accounts are setup to parse the correct sales tax either by

jurisdiction or based on country code(for national sales taxes) then a G/L

search within those accounts for a date range will pull up all the sales tax

activity and show how much sales tax has to be paid for a given date

range.

Within the G/L we will sort the transactions in the Corporate Sales

tax account by date to isolate the sales tax allocated by

date.

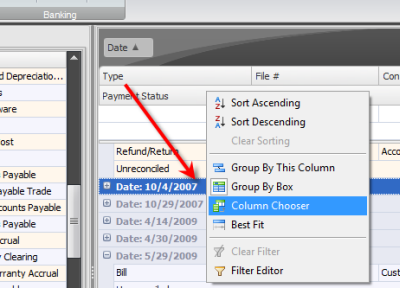

To sort by date, right click on the header field to drag the Date

field from the fields in the Column Chooser into the header within the

G/L.

The column Chooser holds additional options which can be dragged and

dropped onto the header fields in the G/L to highlight how information is

shown.

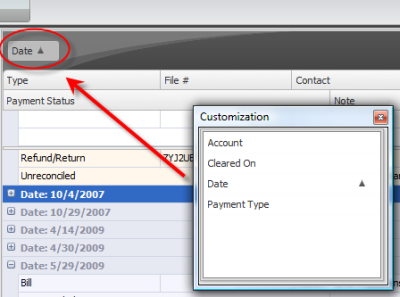

Fields within the header fields can be dropped back into the Column

Chooser to simplify the appearance within the General

Ledger.

How fields appear within the General Ledger will also be what

appears in the print preview screen when a General Ledger account is printed

out. An account print out can be modified to add company logo and contact

information.