11.2.1 Applying Sales Taxes to Existing Products

Apr/12/2009

For Sales taxes

to be applied in each relevant Order/Invoice each sales tax your company

collects is setup within Company Settings and also applied to each product and

service that is taxable.

Generally Sales Taxes have to be collected

based on the location of your company and where you sell to. Please check with

your Accountant for what sales taxes will be applicable to your

company.

For example, if your business is located in New York State you

will have to have the sales tax for New York at the minimum established in your

Company Settings and also have that tax applied to each Product and service you

are selling to customers in New York.

Getting to Sales Tax Settings

within a company follows this path from the Home Tab.

Home---> Tools

tab---> Company icon---> Divisions---> Double click on listed

Division---> Sales Taxes

Once the Sales taxes are established in the

Company Setting they will have to be attached to each product you have for sale

in products. This allows

you to apply Sales Taxes to the Products which will have to have sales taxes

collected on and allow others (usually non-Inventoried items and specific

services depending on the industry) that may not require sales taxes to not have

sales taxes or have only specific sales taxes applied to those Product and

services.

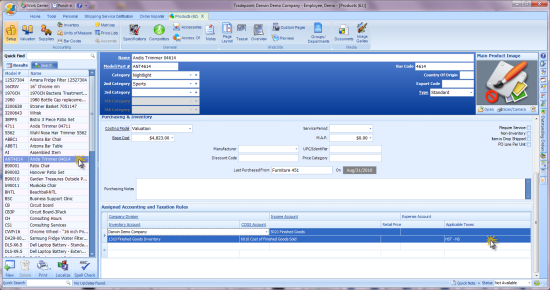

Each product listed in Tradepoint can have one or

more Accounting Rules and each Accounting rule will have Sales Taxes as a part

of that rule.

This

example shows only one Assigned Accounting and Taxation Rule present on the

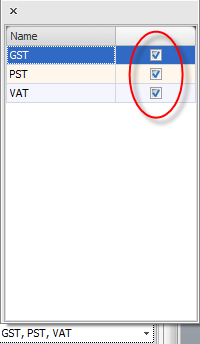

listed Product. Applying specific tax rules for a given Product can happen by

clicking on the highlighted tax field to check off specific

taxes.

Multiple sales taxes are supported within

Tradepoint as well as the application to specific products and services.

Sales taxes will then be applied to only orders and invoices where

the respective postal and country codes are entered.

This allows companies who sell to more than

one market to support VAT for the UK and Europe and GST for Canada as well as

any relevant sales taxes for applicable states in the US.

As additional sales taxes are added to

a Company they will also have to be added to each product to be calculated

within orders and invoices.

If your sales taxes are not coming up

in orders and invoices then check the following items;

- Make sure the Product has the Sales tax

checked off in the accounting rule for the Product.

- Check the Sales Tax in the Company

Information to make sure it has been marked as a national or provincial (state

based) and has all the information as a part of the Sales Tax rule for the

Company.

- Postal Codes check to make sure the

zip/postal code is formatted correctly in both the company profile information

and in the contact where an order or invoice is listed.

- If the zip/postal codes are not

formatted correctly then sales taxes won't pick up properly in sales.