How to Handle Tax Changes in Ontario and BC within Tradepoint

Jun/30/2010

As of July 1st 2010 Ontario and British Columbia (BC) switch to a harmonized

sales tax similar to HSTs throughout the Atlantic provinces. That means

everything that was once only taxable by GST is now taxable by the harmonized

tax at the full tax rate which in both BC and Ontario is the total percentage of

GST + PST (provincial sales tax).

Tradepoint fully supports these harmonized taxes with a little setup and

configuration change. While I'm going to use Ontario as an example this is

applicable for all provinces. Note, if you sell to Ontario customers and are a

Canadian business, no matter where you are, they should be charged HST, thus you

will want to ensure that you have this configuration setup appropriately no

matter what.

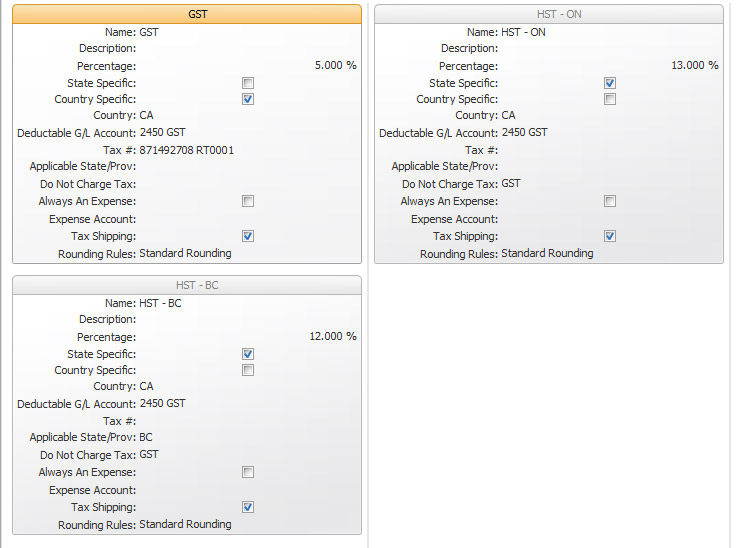

All Canadian businesses should have a GST sales tax setup with a rate of 5%

and set to country specific with the country filled in as CA. This tax is fully

deductable, and thus you will only have a deductable tax account setup pointing

to your GST remittance account. This will apply to all provinces that do

not have an HST. (i.e. Alberta)

Then you'll want to create or convert your Ontario/BC PST to HST. In my

example I have labeled it HST - ON and HST - BC. These are your harmonized

version of the GST and PST.

You'll then want to set it to be state specific and enter ON (or BC as the

case may be) and set it to the tax rate (13% for Ontario and 12% for BC) and set

the deductable account to your same GST remittance account. This is an important

change because you will not longer have a separate PST remittance as it all goes

to the GST office. You'll then set the "Do Not Charge Tax" to the GST

country specific tax that you specified before. This will ensure that only your

HST will be calculated and not the GST as well.

All HSTs, like the GST are fully deductable. That means that if you pay it,

it gets deducted from what you owe the government, if you charge it, it gets

added to what you owe. The difference is what you send in or will receive back

from the government, thus ensure that you uncheck the always expense checkbox

and clear the expense account as it is no longer applicable.

Below is an example of how your taxes should be setup to correctly handle HST

within BC and Ontario. Obviously for all other provinces you should also have

HST configured as applicable in a similar manner: