1.4 Sales Taxes

Jan/29/2009

Tradepoint provides the ability to apply sales taxes

to a national, state/provincial level or a locality or locality based on a

postal/zip codes giving you the ability to apply sales taxes to exactly the

regions relevant to your company. This extends to companies operating in more

than one country with different tax requirements.

Three

items have to be in place for sales taxes to automatically pick up as sales

activity is processed.

- Sales taxes within Company

Settings

- Sales Taxes attached to your

Products

- The Address and Zip Code of your

Company has to be formatted using the Address wizard.

Companies based out of Canada will be able to create

the GST, PST and respective HST or QC taxes depending on the location of the

companies and the customers they serve.

For US based sales taxes multiple

levels of taxation are supported including states like California and Florida

where locality taxes are required in some cases, and varying tax rates based on

County or Zip Code are prevalent.

We will be reviewing examples of

functions that support these cases in this section of the Setup

Guide.

Since most companies will have at least one if not several sales

taxes, Tradepoint supports an unlimited number of sales taxes and each of them

will be displayed as a digital note card for easy viewing at a

glance.

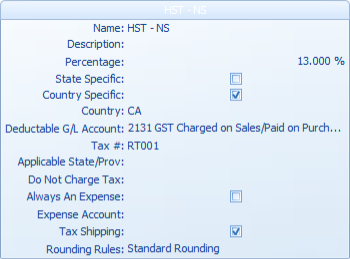

Creating your tax rules is done with the 'New Sales

tax' icon in the lower right. Clicking on this will open one or more cards you

see above. Each of the fields within one card can have information typed in

manually or enter in a series of Zip/Postal Codes for a specific tax.

Clicking on any of the field will allow you to enter

in the relevant information and access your Chart of Account information to

enter in a default Account for a Deductible G/L Account or an Expense Account if

relevant.

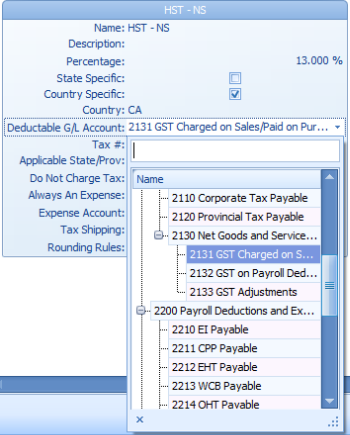

Each

Sales Tax can have its own account.

It is ideal to have an account in

your G/L for each state you have to account sales taxes for though not

necessary.

For example for different state sales taxes an account in the

G/L can be set up for each state that you have to report sales taxes for. Then

at the end of the accounting period an activity report can be submitted along

with any remaining payments for that state.

In the

image above you can see by clicking on the sales tax account field you

can access your G/L and specify an account by clicking it once.

For States where varying tax amounts exist either

by zip code or county Tradepoint will support varying tax codes within one

state. For states with varying tax code by county the tax codes will have to be

entered by zip code. States that have varying tax rates by county will often

post this information on their websites. California is a good example with all

of their tax information posted on the website by

county.

http://www.boe.ca.gov/cgi-bin/rates.cgi

From

here some counties will have to be broken down by zip code, and some counties

will be comprised of two tax rates depending on the zip code. Some websites

provide a county break down by zip code if you don't have all your tax

information in one Excel file for example.

Be sure to check with your

Accountant about your sales tax information to ensure you are accounting for

everything you are required to. Below are a few links for search tools by city

or locality in relation to zip codes.

http://zip4.usps.com/zip4/citytown

http://www.50states.com/