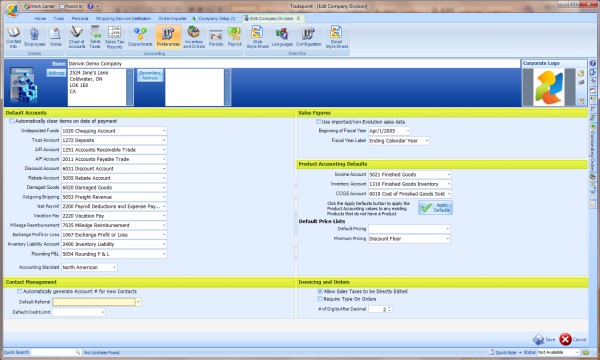

3.10 Accounting Default Preferences

Oct/24/2005

Tradepoint supports preferences

within your Company Settings. These will enable you to set defaults for a

number of actions within Tradepoint. This automates many basic actions as you

conduct business.

Default Account

Preferences: These Accounting preferences will assign the default sales and

transaction activity to the respective accounts you assign. The only required

default accounting preferences are undeposited funds, A/R and an A/P

account.

Note: If you need to create one of these accounts

while setting up the preferences you will be able to do so by toggling back and

forth between the COA section and the Preferences section. As soon as an account

is created within the COA it will be accessible in Preferences. You will NOT

need to save your changes to Company Settings to access a newly created

account.

- Undeposited Funds: This account is used for checks and

cash before they are deposited into a bank account. A subsequent deposit will

take the money from this account and put it in the bank account as a single

entry. This facilitates bank reconciliation as only a single entry will show

up.

- Trust Account: This account is used for pre-payments both

A/R and A/P so that the funds are not recognized as revenue or payables until

such time as an invoice or bill is issued. All prepayments will require that

this account be filled out before allowing you to proceed.

- A/R Account: This account is your accounts receivable

account used for Invoices, payments, and credit memos to record revenue. It is

the reciprocal of income on the invoice side, and the bank account/undeposited

funds account on the payment side.

- A/P Account: This is your accounts payable account used

for Bills, payments and credit memos to record liabilities. It is the

reciprocal of expense/COGS on the bill side and the bank account account

on the payment side.

- Discount Account: This is not yet used and can be left

blank at this time.

- Rebate Account: This is not yet used and can be left

blank at this time.

- Damaged Goods; This account is used for credit

memos/returns/refunds to indicate that inventory is damaged and the cost

associated with the damage (whether it is returnable at a discounted rate to

inventory or fully written off.)

- Outgoing Shipping: This is all revenue as a result of

shipping. This minus your shipping expenses/COGS will give your profit or loss

on shipping and should be checked periodically to ensure that you are not

losing money on shipping services.

- Net Payroll: This is similar to A/P and is the total of

all transactions for a given payroll period. Thus it includes all payments to

employees and all employer portions of all deductions.

- Vacation Account: This is the account used to hold

vacation pay that is being held back for your employees. You will pay out of

this account when the employee redeems his or her vacation pay.

- Mileage reimbursement: This is the account used for

expense reports to account for Mileage.

- Exchange Profit or Loss: This account is used for

recognizing profit or loss on transactions such as invoices and payments. It

can also be used for periodic updates based on exchange variance from what was

your expected exchange rate, versus what you were actually charged.

- Inventory Liability Account: This is the reciprocal of

your Inventory Asset accounts for any received inventory. When you receive a

bill for received inventory, the line items on the bill will be the opposite

of these inventory liabilities and assigned to the inventory liability

account, not the assigned COGS account as COGS is recognized at time of

invoice. Do not assign expense or COGS to the bill for received inventory,

instead use the default Inventory Liability account. The balance on this

account is your variance between expected cost and actual cost on the bill and

can be used to calculate changes to your valuations.

- Rounding P&L: This account is used if you use > 2

decimal places for individual line items. The rounding amount between the line

items and the rounded values that go into and out of bank accounts will be

stored here.

Contact Management: This option will

allow Tradepoint to generate new Account numbers for you automatically. The

number is a computer generated alphanumeric account number. This option can be

unchecked if you have your own numbering system for when new accounts are

created.

Default Referral will allow you to set a default account

to a contact for all referral activity generated in

Tradepoint.

Default Credit Limit will set a default credit limit

for all customers, resellers and suppliers as those accounts are created. If

your company does not use credit limits then leave this field

blank

Sales Figures: If you are using imported sales data then

check off this box. This will set different parameters for the closing

accounting periods for your sales figures.

Beginning of Fiscal Year

establishes within Tradepoint the beginning of the fiscal year for your company

within Tradepoint.

Fiscal Year label is the ending day of the

fiscal year for your company. This sets the yearly closing period for your

accounting activity.

Products Accounting Defaults: These are

accounting rules for your Products. Setting these here will often be a

considerable time saver instead of applying each accounting rule one by one to

your Products. Clicking the 'Apply Defaults' icon will automatically apply your

defaults to all Products within Tradepoint. This process can be repeated if/when

new Products are imported into Tradepoint at a later

date.

Invoicing: Check of the option to allow your Sates Taxes to

be editable. This will allow sales taxes to be edited within all open Invoices.

For charging Sales Taxes on shipping this option will automatically calculate

taxes on shipping amounts for Sales orders that are shipped

out.

Note: All preferences will extend to your Ecommerce

processes automatically when using one of our Ecommerce solutions or web

services to manage your Ecommerce activity.