3.8 Sales Taxes

Oct/24/2005

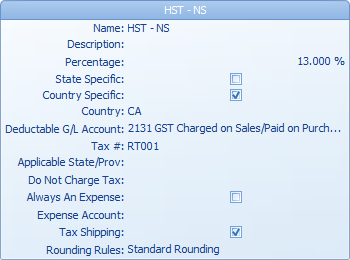

The Sales Taxes screen

allows you to configure the sales taxes that are required in your area. Once

configured, the system will be able to automatically apply the appropriate taxes

for you customers. Multiple taxes can be configured in this section. When you

have entered in the information for one then click the New Sales Tax icon  . A new window

like the one you see below will open for each sales tax allowing you to track

sales taxes by locality.

. A new window

like the one you see below will open for each sales tax allowing you to track

sales taxes by locality.

Name: Enter the Name of

the tax as you wish it to appear on invoices.

Tax #: Enter your

company's tax number.

Percentage: The percent

value of the tax, entered as a decimal value (0.07 = 7%).

State Specific: Check this

box if the tax only applies to customers in a specific

state/province.

Country Specific: Check

this box if the tax applies to all customers in the same country as the

Division.

Applicable States: If the

tax is State Specific, and the state involved is not the same state as the one

that the Division is in.

Do Not Charge: This allows

you to override another tax that would normally be changed if this tax was not.

This is useful for harmonized taxes.

Deductible G/L Account:

Select the liability account that you wish to have the tax portion of money

deposited into when a payment is made.

Always Expense: Check this

box if this tax is redeemable as a business expense.

Expense Account: Select

the expense account to credit when a payment is made.

Tax Shipping: Use this

option if you are required to charge tax on shipping costs for

orders.

Rounding Rules: Some

shippers perform rounding past 2 or 4 places to the right of the decimal point.

To maintain a balancing ledger choose the rounding rule that will apply with the

integrated shipping service that you are using.