1.4.1 Setting Up Sales Taxes Based on Zip Code

Jan/29/2009

Since only some states have sales

taxes that extend all the way to the local level, we are going to use a

California city (San Diego) to illustrate how to create your state sales tax

information for varying rates by county within Tradepoint manually.

In

this case we will use the zip code range for San Diego to show how a range of

zip codes can be entered and then adjusted if necessary.

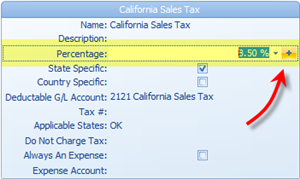

From a sales

tax card in Company Settings the Percentage field will show the place to enter

in the amount and if highlighted a plus sign at the far right (highlighted in

the example below).

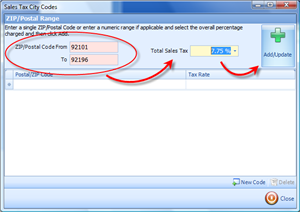

Clicking on the plus icon will open

the zip code wizard to upload a range of zip codes with a give rate. You can

enter in several ranges before saving changes to your sales taxes.

A default amount can be

entered in to this field which will apply to every California zip code, unless

additional zip codes with different tax rates are set using the plus icon on the

far right.

When additional zip codes are set any different amounts will

over ride the main amount you see here when sales happen in those zip

codes.

Enter in the Zip/Postal code range

in the circled fields. Then enter in the rate in the next field. Click the

Add/Update icon to apply this to the range of zip codes.

Note: This tool

supports use of the 4 digit extensions in Zip/ Postal codes for US based Zip

codes.

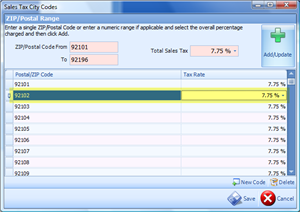

When you have finished with that

range they will pre-populate in your screen as you see below.

- Multiple ranges can be entered in

here before saving.

- Single Zip/Postal Codes can be

entered in here.

- Individual Zip/Postal codes can

be edited after the fact by clicking on the field and changing the amount.

- A scroll bar on the right allows

you to scroll to a specific zip code to update or change it.

Save your changes to update your

Zip/Postal Codes.

Each Tax Card in your company

settings can have additional detail as shown in the example above or the main

tax rate entered in on the 'Percentage' field will act as a default for that tax

rule.

Tax rules can apply to a national, state/provincial or local level

based on the settings you apply to them.