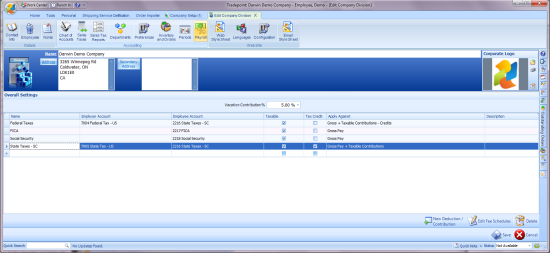

3.12 Payroll Setup in Company Settings

Feb/22/2008

Tradepoint's Payroll

settings for companies is established through the Company Settings under the

Payroll icon you see in the tool bar shown below.

Since the Payroll settings can apply for

different types of withholdings including flexible spending plans, health care

plans, and additional deductions such as child care and garnishments there are

two levels to the payroll settings. The first level of information is found

in the Payroll Screen that shows each type of Payroll deduction that applies to

this Company/Division in this window.

Each company or Division can have its own

Payroll structure specific for that Company/Division. Each of the tax structures

will need to be set up manually for multiple companies or divisions.

1. Deductions for this company are listed

above.

2. Each of these fields are editable and drop down menus exist to

select the correct account for the Payroll Expense and Payable Account.

3.

Clicking on the 'New Deduction" Account will open a new set of fields for a new

payroll deduction.

4. Highlighting any of the line item fee schedules and

clicking the 'Edit Fee Schedules' icon will take you to the screen you see below

to edit the details of your deduction fee schedules.

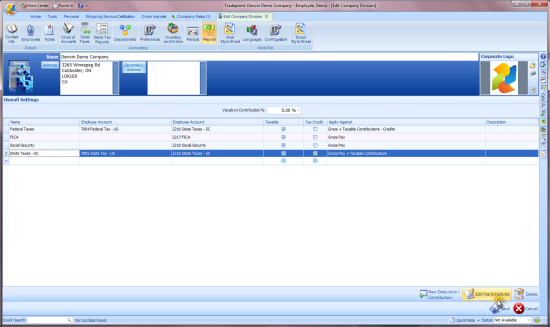

The view you are seeing above shows a

single fee schedule for one Deduction. This is the second layer of information

for payroll deductions. Each Deduction can have multiple fee schedules attached

to it.

For example, federal tax with holdings may

be different depending on the amount of income that is being earned so the

federal tax with holding structure you see here would have as many different fee

schedules as applies to this payroll deduction.

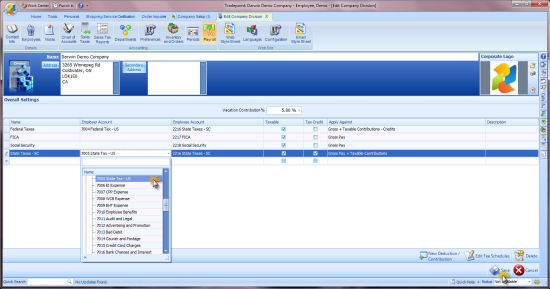

Below is an example of established fee

schedules within your Company Settings for one tax.

1. Click the 'New' icon in the lower left

corner to open a new or subsequent fee schedule.

2. Each of the highlighted

fields is either editable or has built in drop down tools for calculators or to

specify accounts for expenses or payables.

3. Always enter in a start date

for the fee schedule and for general purposes you may want to leave the End Date

open. When the End Date is left open the deduction will apply

continuously. Unless the specific deduction is for a specific time leave

the End Date empty. If an

end date is set then the deduction will automatically stop after that End

Date.

4. Fields for the fee schedule include: Pay Range,

Employer Contributions, and Employee Contributions.

Tradepoint will calculate the deductions

based on these fee schedules and the Employee compensation settings within each

Employee file. The settings here and within each Employee file will determine

what is calculated when the payroll wizard is processed.

Be sure to save your payroll settings

within the company settings when you establish your payroll deductions and fee

schedules.